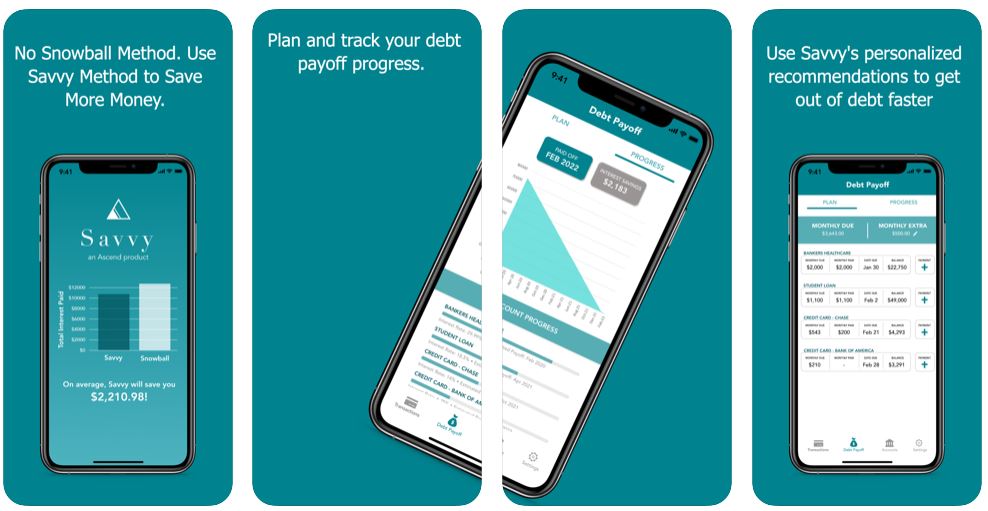

Setting financial goals provides a framework for determining what is important to you financially and what is required to achieve these financial milestones. Sticking to your plan for these goals can help shape your attitude towards your finances and help to provide a level of discipline that will carry over to all aspects of your financial life, getting started and saving for this goal regularly is critical because time and the busy work keeps us going by making us forget all our financial dues in life which is so very mandate to move on. So here comes savvy debt payoff planner as the lifesaver to save you from your debts and make you free from the debts for the lifetime.

Is savvy really savvy?

- It is simple and handy to use just with the help of your ios phones and internet

- security, automation and customization are the key features of the Savvy debt payoff planner app.

- Interest can be saved using Savvy debt payoff planner

- It’s a secured app since 256-bit bank-level encryption is used

- This app doesn’t use any personal information. All the data received will be read-only

- Simple accessible features to make the payments easier on time without difficulties and delay

- If you add all your bank accounts, credit card accounts or the loans payable this app will automatically generate the date and will pay on time without adding extra interest for late payment

- It’s a fun experience

The needs of savvy debt off planner

- Security is their priority since all the accounts are been added to the app. No one can access it since it is 256-bit bank-level encryption

- The budget was automated and debt payoff planner will pay it on time by saving time and money

- Debt payoff planner can be customized to the needs of the customer to satisfy the customer

- Savvy tracks the debts and spends wisely

- Savvy is ad-free and uses automation to make life simpler

- Debt-free freedom will be gained by the user

- You don’t need to be concerned about when to pay and how much to pay every month.

- Once the minimum subscriptions are paid savvy will guide you where to put the extra money

- Debt payoff planner gets you out of the debt and makes you happy

- Savvy debt payoff planner method provides the psychological benefit from the snowball method and the interest savings of avalanche.

Conclusion

The best solution to strike a balance between saving and paying off debt is Savvy pay off planner. It also ranked #1 as the best debt payoff app 2020. Worth every penny. Additionally having sufficient savings provides peace of mind.

Compatibility

Requires ios 10.0 or later, compatible with iPhone, iPad, and iPod touch & Android